Not sure what a term or phrase we used in this API means?

Not sure what a term or phrase we used in this API means?

Find your answers in our glossary. We have grouped terms alphabeticaly based on the first character of the term or phrase.

Feel free to suggest terms.

Netcash Glossary

| Abbreviated name | refers to Debit Orders | Part of the debit order compliance requires the application for an abbreviated name that appears on the account holder’s bank account when a debit order is processed to their account. This 10-character reference is required to be unique. |

| ACB | Automated Clearing Bureau now referred to a BankServ Africa | The central clearing house is required by the South African banks to process transactions through the National Payments System. |

| Action Date | Payment/Collection date | The date a transaction will be effective on the clients’ bank account. |

| API | Application programming interface | An Application Programming Interface (API) is a set of subroutine definitions, protocols, and tools for building software. |

| Available balance | Money at your disposal | The current balance in your Netcash account less retained amounts |

| Authorize | Instruction | Authorizing is giving Netcash instruction to process the batch. |

| Banking day | Operating hours of the financial system in ZA | A banking day is the period of time during which a bank is available for transacting |

| BankServ | See ACB above | |

| Batch | Group of transactions | The aggregating of transactions in one file for processing on the same action date |

| Beneficiary | Someone/Entity who receives | An individual or company that receives payment ( creditor or employee).creditor |

| Compliance | Mandatory bank process | A process implemented by the banking council and PASA to ensure that debit order collections are legitimately processed. Netcash goes through a compliance process with all debit order clients. |

| Cloud | Cloud computing | Processing of transactions in a virtual environment. The Netcash system is internet/cloud based and as such no computer hardware or software is required to make use of the Netcash service. |

| Creditor | You owe money to | A creditor is a party who is owed money |

| Credit Bureau | Vetting facility | An agency that provides credit information for mitigating risk. |

| Credit Card Issuer / Card Issuing Bank | Bank who issues a card | Bank who issues a card Any financial institution that issues bank cards to their clients. |

| Credit Report | Status of financial stability | A detailed report of an individual’s credit history prepared by a credit bureau and used by a lender in determining an applicant’s creditworthiness. |

| Deadline / Cut-off | End of allocated time | The time in which a Netcash client has to submit and authorise a batch for a particular action date. The cut-off time/deadline is determined by the service selected. |

| Debit Order | Electronic collection of funds. | A debit order is a way for a third party, with permission to collect money from a bank account. Typical uses are monthly subscriptions, insurance premiums or loan repayments. |

| Debit Order Mandate | Authority to debit / Instruction | a Debit Order Mandate is the voice recorded or written or electronic authorisation given by a account holder, authorising the Netcash merchant to deduct from the account holder’s bank account an agreed amount at predefined intervals in favour of the merchant. A merchant would request payment, through the Netcash System, from the account holder’s bank, based on this authorisation. The account holder therefore gives permission for a debit order to be processed against his/her bank account. |

| DebiCheck | Advanced electronic collection of funds. | DebiCheck is a secure debit order payment method that allows an account holder to electronically approve debit order details directly with their bank in favour of the Netcash Merchant. |

| Dispute | Disagreement between account holder and service provider | A dispute occurs where an account holder formally contests the authorization of a transaction. This may result in an unpaid transaction . |

| Debtor | Owes you money | A debtor is an entity that owes a debt to another entity. The entity may be an individual, a firm, a government, a company or other legal person. |

| EFT | Electronic Funds Transfer | Electronic funds transfer (EFT) is the electronic transfer of money from one bank account to another, either within a single financial institution or across multiple institutions |

| FICA | Financial Intelligence Centre Act | the Financial Intelligence Centre Act 38 of 2001, (the FIC Act) came into effect on the 1st of July 2003. The FIC Act was introduced to fight financial crime, such as money laundering, tax evasion, and terrorist financing activities. |

| Gateway | Payment gateway | A payment gateway is a service provided by an e-commerce application service provider that allows for payment processing for e-businesses and online retailers. |

| GUiD | A Globally Unique IDentifier (GUID) | a 128-bit number used to identify information in computer systems |

| Help Center | Documentation | Netcash Help Center is a comprehensive resource for Netcash-related service assistance |

| Inbound Payment | Receiving payment | Payment received by you – usually via debit order or eCommerce payment method | ||||

| Instruction | File instruction | Each batch file being sent to Netcash contains an instruction which is the purpose of the file. It is included in the header record to tell the Netcash system what to do with the file or which service to use. For example: The Debit Order file can have one of the following instructions:

whereas the outbound Payments file can have one of the following instructions:

Please refer to each service for its Input File Structure to see the correct unique Instruction for the particular service. For further assistance contact support |

||||

| Issuing Bank | Bank that issues a card | An issuing bank also known as card issuer is a bank, financial institution or credit union that is affiliated to the card association brands and provides credit or debit cards directly to customers. | ||||

| ISV | Integrated Software Vendors | Integrated Software Vendors (ISV) are companies who develop -and retails software which communicates with Netcash to enable transaction processing via the Netcash system. | ||||

| Limit | Service Limit | A security limit which is imposed on transactions and or batches to control risk. |

| Lead Generator Key | A unique Netcash system-generated GUiD used to transmit data for the opening of new merchant account/s to the Netcash system | Certified Netcash Integrated Software Vendors (ISV) may apply for a unique Lead Generator Key (LGK). The LGK is used to transmit the data required to open a new Netcash account. |

| Load report | System-generated data feedback of data submitted | The load report contains the status of the data that was sent to Netcash and it’s status post-upload. It will have a status in the result field |

| Mandate | eg. Debit Order Mandate | An instruction that a bank account holder gives to the bank to allow a third-party to collect an amount directly from the bank account either once off or on a recurring basis. For more see Debit Order Mandate |

| Merchant Token | GUID for Scan to Pay | GUID generated to facilitate QR code payments via Pay Now – Scan to Pay service. Read more about the service and how to obtain the Merchant Token |

| Merchant Service | Processing facility | Merchant services is a broad category of financial services intended for use by businesses. |

| Netcash Client | Netcash account holder | A Netcash client is the company/entity making use of the Netcash service. Formerly known as a “Netcash merchant” |

| Netcash Merchant Account | Online facility | a Netcash merchant account refers to the virtual account a business will open with Netcash to make use of our services via a secure cloud based infrasructure. |

| NetAccess | System feature | NetAccess is used by Integrated Software Vendors (ISV’s) to integrate Netcash services into a host/remote application. |

| NetConnector | System feature | NetConnector is the place in an application where a Netcash customer will enter details to enable communication via the host software to Netcash |

| Online Banking | Internet/Web Based Banking | A service that allows an account holder to obtain account information and manage certain banking transactions through a personal computer via the financial institution’s web site on the Internet. (This is also known as Internet or electronic banking.) |

| Outbound Payment | Making payment |

Refers to creditor and salary payment transactions where YOU are paying someone else. A creditor and salary payment transaction where payment is made to a third party |

| PCI | Payments Card Industry | The Payment Card Industry Data Security Standard (PCI DSS) is an information security standard for organizations that handle branded credit cards from the major card schemes. |

| PASA | Payments Association of South Africa | The Payments Association of South Africa (PASA) is the governing body that regulates transaction processing in South Africa. Netcash and all other third party payment providers (TPPP’s) must adhere to the rules and regulations set forth by PASA. |

| Plugin | Add on software | a Plug-in module or plug-in software is used in conjunction with Netcash systems. Ie. Shopping cart plugins. |

| Postback URL |

Gateway response |

The eCommerce gateway utilizes four response URL’s to redirect the payee once the transaction has been completed. They are:

|

| Point of Sale (POS) | Card reader | Systems and hardware devices that allow bank customers to effect transfers of funds from their accounts and other financial transactions at retail establishments. |

| Processing | Doing something | Online processing is an automated way to enter and process data continuously as use as the information becomes available. |

| Public Beneficiary / Recipient | Beneficiary Type | A Public Beneficiary / Recipient is a recipient like a municipality or clothing store. These payments are selected from a list and you don’t need to enter the banking details. The correct reference number (usually your account number) is required for the payment to be allocated. Always use branch code “000000” and account type “9” when making payments to these accounts |

| Quick Start Guide | Help guide | An easy to use reference guide aiming at assisting the user in performing certain tasks. Quick Start Guides are developed by Netcash and frequently updated to the latest screenshots and procedures to assist the end user. |

| QR Code | Quick Response Code | A QR code is used used in the Pay Now Scan to Pay Service. To generate the QR code a Merchant Token is required. |

| Retention | Surety Retention | A percentage (%) of the batch value is held back for 30 (thirty) days and provided to the bank as a gaurantee of the transactions processed. This is done to mitigate the potential risk. |

| RTC | Real-Time Clearing | Allows for faster clearing of payments. Real-time clearing (RTC) – known by terms like Pay & Clear and Instant EFT to the end consumer – allows for payment clearing with minimal delay. |

| Retention | Unpaid Retention | A percentage (%) of the batch value, (based on historical unpaid statistics calculated over a 90 day period) is held back for 30 (thirty) days to make provision for possible unpaid transactions. |

| Result | File upload |

Result of upload file status

see examples here |

| 3D Secure | Online card security | 3D Secure is an XML-based protocol designed to be an additional security layer for online credit and debit card transactions |

| Settlement | Settlement model | Rather than holding back unpaid retention/s which could vary in percentage from month-to month, Netcash retains all the funds for a shorter period of time and then pays such out (settlement) to the client |

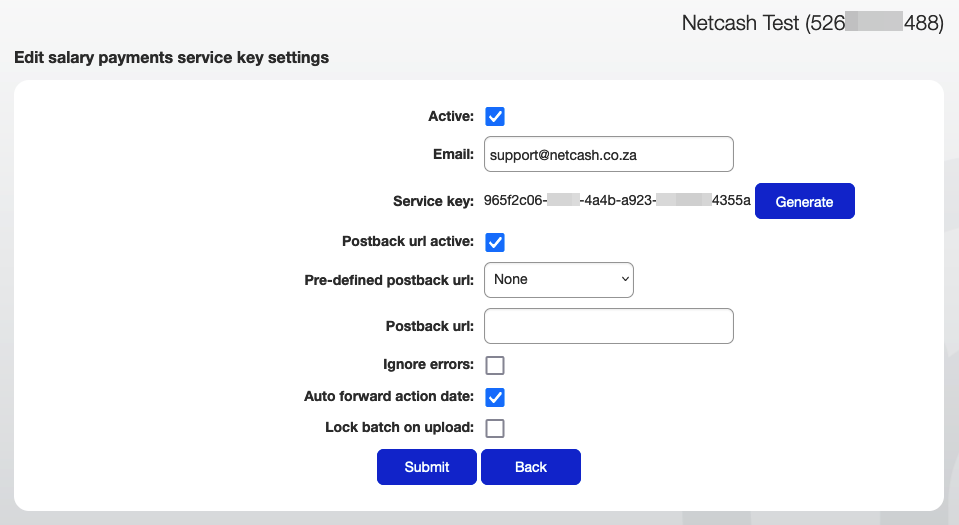

| Service Key | A Netcash system-generated GUiD used to identify Netcash services and process instructions. |

Each Netcash service has its unique Service Key which the Netcash user generates on his Netcash Account. The Service Key has variables/parameters assigned to it. Each Netcash account will be issued a separate Service Key for each service activated on the account. The Service Key prevents unauthorized access, identifies the Netcash Account where transactions are to be processed and identifies the Netcash service to which the Service Key belongs. The Netcash client has full access to the NetConnector section of their own Netcash account and can therefore regenerate a Service Key or change its parameters at any time.

|

| Signatory/ies | Authorised person | A director and/or shareholder of a Company, member of a Closed Corporation or trustee of a Trust. The person/s signing surety for the Netcash account. |

| Software Vendor | Companies that develop -and retail software | See Integrated Software Vendors (ISV) |

| Software Vendor Key | A unique Netcash system generated GUiD used to identify transactions processed by third-party systems via the Netcash system. | Certified Netcash Integrated Software Vendors (ISV) may apply for a unique Software Vendor Key (SVK). A Software Vendor Keys is used to identify the software which generated the transaction/s for processing via the Netcash system. |

| Superuser | Senior system user | Usually a director of a company. The super user has system permissions to set other users’ rights and responsibilities/permissions. |

| Transaction | Input message to a computer system dealt with as a single unit of work | A transaction is a line of code which contains all the variables required by Netcash to proces the data to the banking system. |

| Unauthorize | Instruction | Unauthorizing a batch/transaction is removing/cancelling a prior instruction/approval given to Netcash. Netcash Debit Order and Outbound Payment batches can be authorized and unauthorized. |

| Unpaid | Unsuccessful | An unpaid transaction (see unpaid reason codes) is where the bank returns the transaction to the Netcash system for a number of reasons including but not only limited to insufficient funds. It is not a disputed transaction. |

| Upload report data | File upload status |

Upload report example (successful): ###BEGIN MY TEST BATCH SUCCESSFUL 01:59 PM R1.00 20160410 ###END 01:59 PM Upload report example (successful with errors): ###BEGIN MY TEST BATCH SUCCESSFUL WITH ERRORS 01:29 PM R1.00 20160410 Acc Ref :XI5 Line :3 Account details could not be validated. Please check the fields Bank account type, Branch code and Account number. Acc Ref :XI5 Line :3 Bank account number has incorrect length (min 4, max 11 characters) Acc Ref :HCOS1 Line :5 Beneficiary statement reference has incorrect length (min 4, max 20 characters) Acc Ref :HCOZ1 Line :6 Beneficiary statement reference has incorrect length (min 4, max 20 characters) ###END 01:29 PM Upload report example (unsuccessful): ###ERROR: A system error occurred. Please contact Netcash R0.00 20160410 ###END 01:23 PM

|

| Vault | Credit Card Vault | This is a facility housed by the card issuing bank which securely stores the Credit Card details and returns a card token to be used for transacting. Credit card data has to be stored in industry standard infrastructure that is PCI DSS compliant. |

| Validate | Validating requirements for processing | VValidation refers to checking that the requirements and specifications are correct to fulfill its intended purpose. Bank account validation confirms if the account is valid for processing in the South African Banking System. |

| Verify | Confirming the instance | Verification refers to the transactional data being confirmed. Bank account verification uses the account holders ID number and checks such against the supplied (validated) bank account number; to confirm that the bank account is active and does indeed belong to said ID number. |

| Virtual account | cloud based account | Virtual accounts are a set of off-balance transaction accounts linked to a physical bank account, used for improved reconciliation, cash liquidity management in real-time and self-service opportunity for corporates. |

| Web Service | A method used by one system to communicate with another system. | In practice, a web service commonly provides an object-oriented web-based interface to a database server, utilized for example by another web server, or by a mobile app, that provides a user interface to the end user. |

Netcash brand guidelines

Please refer to the Netcash brand guidelines here when using any logos, images, icons, labels, descriptions, and references to Netcash in your software.

Testing

See Testing section for more details. If you require any integration assistance contact our technical support team